Instant Check Stub Generator

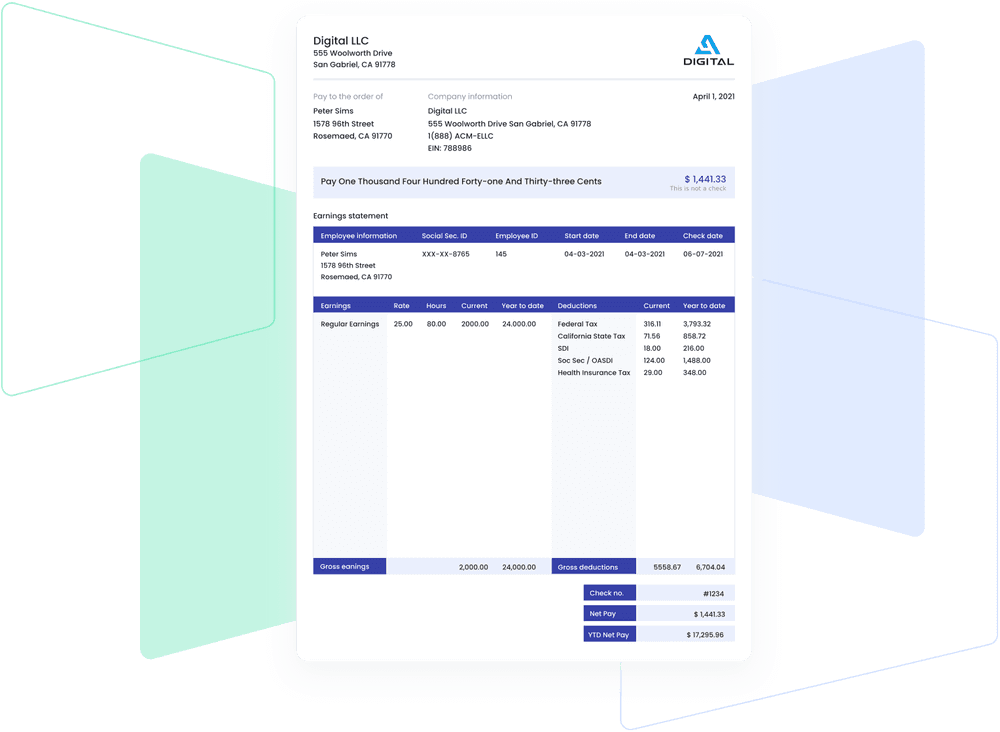

Our online check stub generator makes it easy to create professional and accurate pay stubs in minutes. With no software needed, you can generate, print, and use pay stubs instantly. Try our simple and hassle-free pay stub maker today!

Why should you choose The Check Stubs?

Automatic Calculations

Save Time and Eliminate Errors with Our Pay Stub Generator

Private and Secure

Trust Our Pay Stub Maker to Keep Your Information Safe

Competitive Pricing

Save Money and Get Professional Pay Stubs with Our Service

Get Professional Paystubs in Minutes with Our Paystub Generator

Get professional paystubs in minutes with TheCheckStubs. Say goodbye to manual paystub creation, customize and generate paystubs easily with our user-friendly platform.

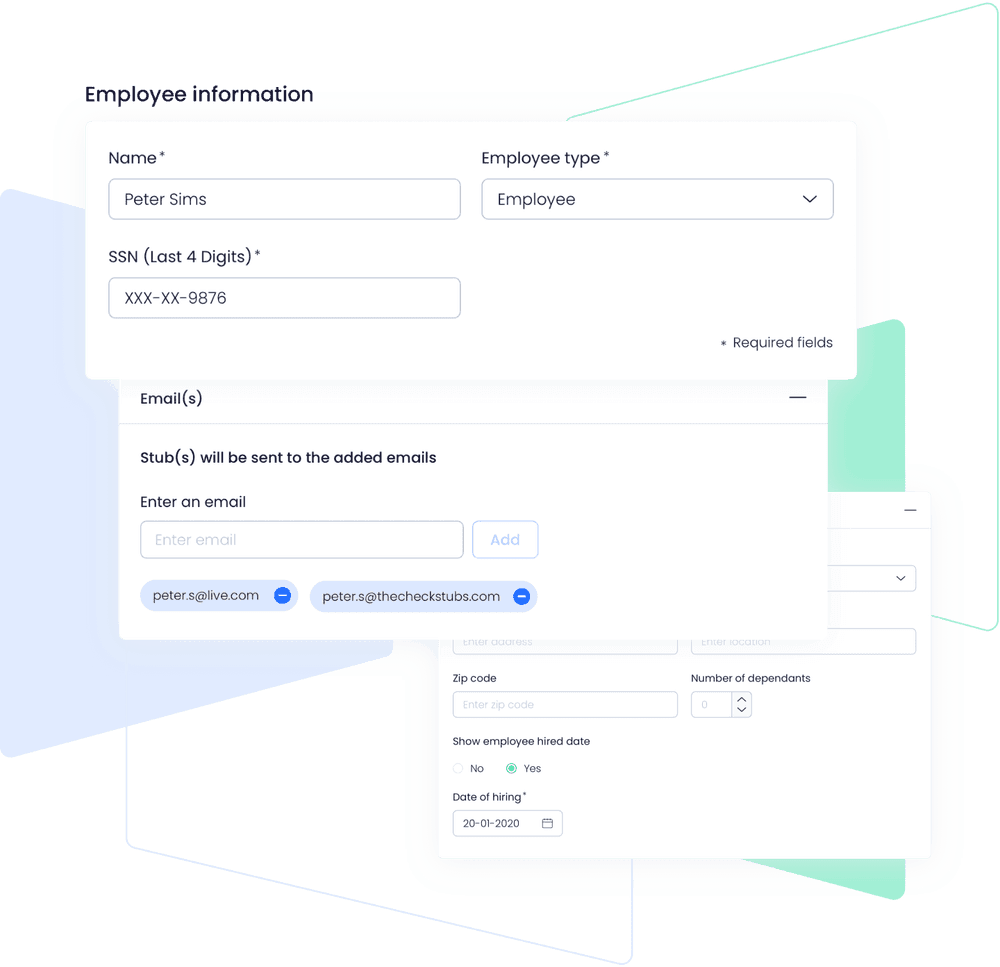

How to Create Your Pay Stub: A Step-by-Step Guide

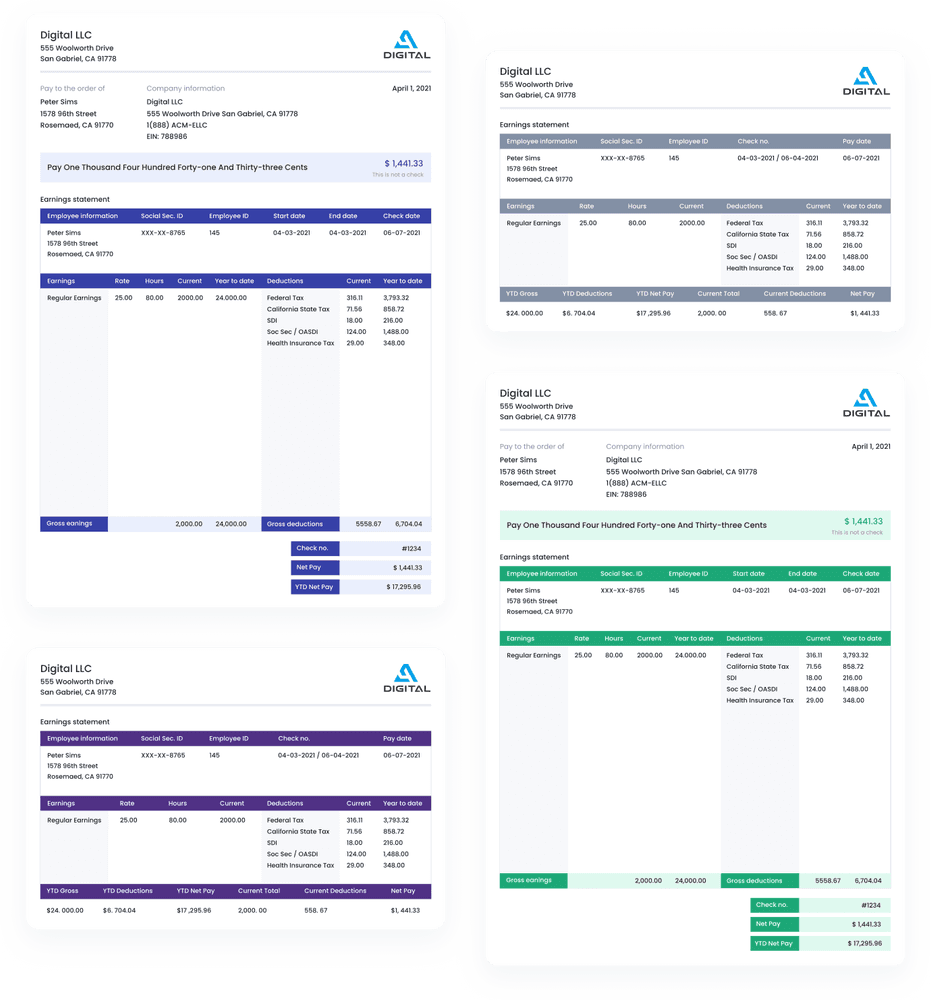

Customize Your Pay Stubs

Make your pay stubs truly unique by customizing them to fit your specific needs. With our easy-to-use generator, you can easily create pay stubs that include your desired information and design elements. Stand out from the crowd and make a lasting impression with your personalized pay stubs.

Affordable Pricing for High-Quality Pay Stubs

Our online check stub generator provides top-quality pay stubs at an unbeatable price. For just $5, you can create professional and customizable pay stubs that meet your specific needs. Say goodbye to expensive payroll services and hello to our affordable and easy-to-use pay stub generator. Plus, with our secure payment system, you can trust that your financial information is always safe.

Useful Information

Every month, your HR team spends time calculating each employee's salary, wages, and deductions. While manual pay stub creation can be time-consuming, it's important to understand the basics before diving into more complex solutions.

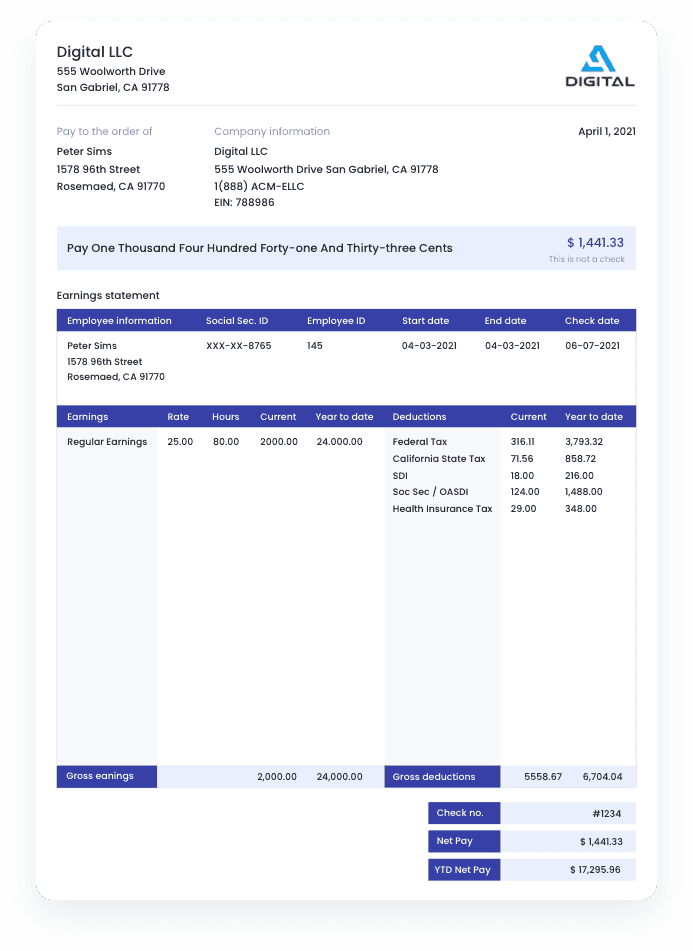

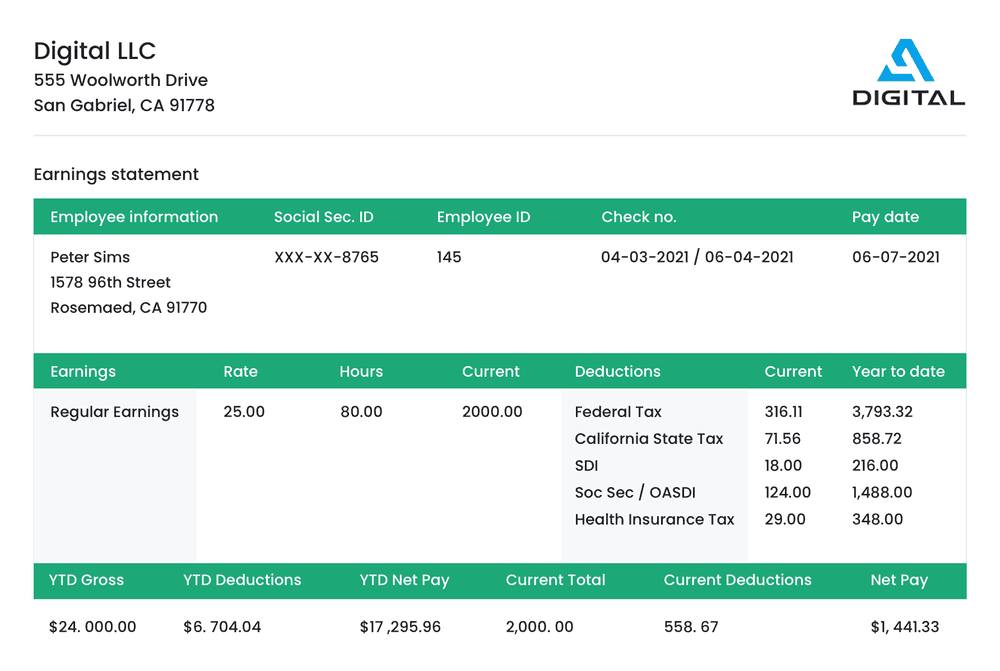

A Pay Stub, also known as a pay slip, earnings statement, or paycheck stub, is a document provided by the employer that outlines the employee's earnings and payroll information for a specific pay period. The pay stub specifically details the net pay, which is the amount the employee takes home after deductions.

Creating pay stubs for your business can be streamlined with the use of a pay stub generator. With the check stubs, you can generate a professional-looking pay stub online in minutes

Make sure your employees have the necessary information about their pay by using the check stubs to generate pay stubs for your business today.

The Importance of Pay Stubs for Employers, Employees, and Entrepreneurs

Pay stub documents play a crucial role in several important situations, especially during tax season. Both employers and employees will benefit from having access to these documents throughout their careers.

For Employees: Pay stubs serve as a valuable source of information for employees for various purposes, including proof of income, income verification, and tax filing. In the event that a W2 form is delayed or lost, a pay stub can be used as a substitute to gather the necessary information.

For Employers: It's essential for employers to maintain records of their employees' pay and payment amounts. This is important for the HR department and can also serve as evidence in the unlikely event that an employee challenges their pay or suspects an inaccurate net payment. Keeping accurate business records is always a best practice.

For Entrepreneurs: Entrepreneurs, contractors, and freelancers need to have a record of their proof of income or pay stubs on hand. Since this group often experiences fluctuations in their earnings, it's important to have a document that tracks their earnings, deductions, and the amount they need to pay in taxes.

Pay Stub Requirements Vary by State

The rules surrounding pay stubs can vary depending on the state in which your business operates. Some states require that pay stubs be printed and physically provided to employees, while others have more relaxed regulations for independent contractors. It's important to make sure your company is in compliance with state and federal laws regarding pay stubs.

While there is no federal law mandating that employers provide pay stubs to employees, the Fair Labor Standards Act (FLSA) requires employers to maintain certain payroll records. Review the table below to determine if your company is required to provide pay stubs based on state laws.

In the digital age, employees and individuals can easily generate pay stubs online using a pay stub generator.

Employees have several options for obtaining their pay stubs, whether in hard copy or online. If pay stubs are not provided by the employer, employees can explore the following options:

- Direct Deposit: Employees can opt for direct deposit, where their pay is directly deposited into their bank account. This method is convenient and provides digital proof of income, but does not result in physical pay stubs.

- Check Stub Maker: Employees can use a check stub maker or pay stub generator to create pay stubs online. This is a quick and efficient process and helps ensure accurate calculations and proof of income.

- Previous Employer: If a new employer needs to verify work history, they can contact the employee's previous employer. If the employee has multiple jobs, they should collect pay stubs from all employers. However, it's important to understand state laws before proceeding with this option.

By exploring these options, employees can ensure they have access to their pay stubs for proof of income and tax purposes.

When searching for an online check stub maker or pay stub generator, it's important to be cautious as not all software and companies are trustworthy. Some pay stub generators provide fake pay stubs that are of no value to you or your company.

To avoid falling victim to a counterfeit pay stub generator, it's crucial to thoroughly evaluate the options available and choose a reputable pay stub generator that meets your specific needs and requirements.

Creating fake or falsified pay stubs can have serious consequences, but with our pay stub generator, you can avoid these risks. Our platform is genuine, user-friendly, and provides accurate calculations, putting your business in the same league as the elites.

Fake pay stubs and unreliable pay stub generators are becoming more common, so it's important to know how to identify a genuine pay stub. Recent studies have shown that many reported incomes and pay stubs are fake, and the government is cracking down on individuals and organizations that create false documents. The consequences can be severe, including declined credit, job loss, charges of fraud or federal felonies, hefty fines of up to $1 million, and even jail time of up to 5 years.

To maintain a positive reputation for your business, it's best to avoid shady practices and unreliable pay stub generators. Choose a well-trusted and highly-reviewed pay stub generator to ensure your business stays protected.

If you're still relying on a manual or paper-based payroll system, it may be time to consider using TheCheckStubs. Not only it can streamline your operations, but it can also provide benefits for both your company and your employees.

Disorganized Payroll System: A Thing of the Past

One of the most significant drawbacks of using a paper-based payroll system is the potential for errors, loss, or damage to records. Additionally, it requires a lot of manual work and can be time-consuming, leading to unwanted amounts of work for your staff. TheCheckStubs can put all of this behind and create a more efficient and streamlined payroll process.

Keep Employees Satisfied with Accurate Calculations

Have you been receiving complaints from your employees about the accuracy of their pay stub documents or late payments? Inaccurate or late payments can lead to employee dissatisfaction and low morale. TheCheckStubs can take care of all of these issues, ensuring that employees receive their pay on time and accurately.

Staff Shortage: No More Burnout

In small or medium-sized companies, staff shortages can lead to chaos and burnout, especially if the HR department or accounting team is understaffed. TheCheckStubs can reduce the workload for your staff, allowing them to focus on more critical tasks and reduce the chances of burnout.

Why Choose TheCheckStubs?

The above reasons make a compelling case for implementing a streamlined and efficient process for generating pay stubs. With TheCheckStubs, you can avoid the drawbacks of a paper-based system, improve your payroll operations, and keep your employees satisfied. Don't let an outdated system hold your business back; make the switch to a paystub generator today.

Pay stubs are a crucial document for employees, contractors, and freelancers alike, as they can serve various purposes in different life situations. Here are some instances where a pay stub or a generated stub can help prove your income:

Paystub for Loan Application

When you apply for a loan, your pay stub information plays a significant role in whether or not you get approved. This information will determine how much money you earn over a given period and how often you get paid.

Paystub for Large Purchases

If you are making a significant purchase, such as a car or a house, you will likely need to provide recent pay stubs and W2 forms to verify your identity and ability to pay. If you are self-employed, generating pay stubs can help you in such situations.

Paystub for Renting an Apartment

When renting an apartment or office space, landlords often require a few recent check stubs and personal identification documents for verification. In such cases, you can request pay stubs from your employer or generate them yourself.

Paystub for Compensation and Claims

In the unfortunate event that an employee suffers an injury and needs to file for worker's compensation, a pay stub can help verify how much they would have made if they had not been injured.

Paystub for Tax Filing

To properly file tax returns, companies and individuals need to have all the necessary paycheck stubs in place to determine taxes paid during the year.

Besides the above use cases, pay stubs can also serve as proof of income in other scenarios such as applying for a visa or disability benefits, buying a house or getting a mortgage, and for drivers and dispatchers.

It is essential to stay aware of and comply with current tax laws and TheCheckStubs can be a helpful tool to quickly generate a pay stub when needed.

Pay stubs can be overwhelming, with many codes and abbreviations that may not make sense to the average employee. Without clear guidelines from the company, deciphering a pay stub can be a daunting task. However, understanding your pay stub can help you verify that your calculations are correct and that you're receiving the appropriate payments.

During tax filing season, accurate pay stubs are crucial for both employers and employees. As such, it's important to be able to read and comprehend them properly.

One of the most confusing abbreviations found on a pay stub is YTD. Here are some of the common deduction codes and abbreviations that you may encounter on your pay stub:

- FED TAX: Federal Income Tax Withheld

- STATE TAX: State Income Tax Withheld

- MEDICARE: Federal Medicare Withheld

- ERA: Educational Retirement Act Contributions

- FICA: Employees' Portion Of Paid Social Security

To make sense of these codes, you can refer to a comprehensive guide to pay stub deduction codes, which can help you decipher an employee pay stub in just a few minutes. This can save a lot of time and effort for both the employer and the employee.

Pay stubs are commonly used as proof of wages or salary for both employers and employees. Having a record of two or three previous paycheck stubs can be very useful. However, there are also other ways to demonstrate your ability to make payments, such as showing bank statements or tax return documents.

Having online pay stub forms available at any time is a convenient way to ensure that you have the necessary proof of income if an unexpected audit occurs. By using a pay stub maker, companies can safeguard employee information and important documents, reducing the risk of theft or damage.

If your company creates pay stubs online, it's important to back up all necessary documents and ensure that they are securely stored. It's also essential to dispose of sensitive documents, such as those containing social security numbers and taxes, in a secure manner to prevent fraud, scams, and identity theft.

In summary, while pay stubs can be used as proof of income, it's always a good idea to have additional documents to demonstrate your ability to make payments. Employers should take appropriate measures to safeguard employee information and important documents.

Start creating your pay stub for as little as $5 today!

By utilizing our paycheck stub calculator, you can easily manage your finances, apply for bank loans and credit cards, and use the pay stub as proof of income and a reliable work reference.